Ministerstvo financií SR (MF SR) zohráva kľúčovú úlohu v rozvojovej spolupráci Slovenska. Okrem vlastných aktivít v oblasti ODA zabezpečuje príspevky medzinárodným organizáciám a finančným inštitúciám a spolupracuje s rôznymi partnermi vrátane Rozvojového programu OSN (UNDP), EXIMBANKY SR, programu PEFA (Public Expenditure and Financial Accountability – Verejné výdavky a finančná zodpovednosť) a organizácie Center for Excellence in Finance (CEF) v Ľubľane. Okrem toho je členom iniciatívy The Addis Tax Initiative (ATI). UNDP je však najstarším a najväčším partnerom z hľadiska finančných príspevkov aj počtu projektov.

KĽÚČOVÍ PARTNERI MF SR PRE ROZVOJOVÚ SPOLUPRÁCU

Slovak Transformation Fund

Okrem projektu PPFD realizujú MF SR a UNDP iniciatívy zamerané na podporu zavádzania inovácií vo verejnej správe a verejných financiách.

V roku 2022 spustili projekt Slovenský transformačný fond (STF) ako nástupcu projektu Transformatívne vládnutie a financovanie (projekt realizovaný v rokoch 2015 až 2021).

Cieľom tohto projektu je podporiť mestá implementáciou inovatívnych prístupov a finančných riešení v kritických oblastiach. Zameriava sa predovšetkým na posilnenie transformácie prostredníctvom participatívneho hľadania systémových prístupov a budovania systémov, ktoré umožňujú zmenu a využívanie inovatívnych riešení podporovaných inovatívnymi zdrojmi financovania. Najnovšia výročná správa v angličtine tu.

Projekt tvoria dve zložky: City Experiment Fund, zameraný na transformáciu mestských systémov a skúmanie nových mechanizmov financovania, a akceleračný program BOOST, ktorý podporuje inovácie pre vybrané výzvy.

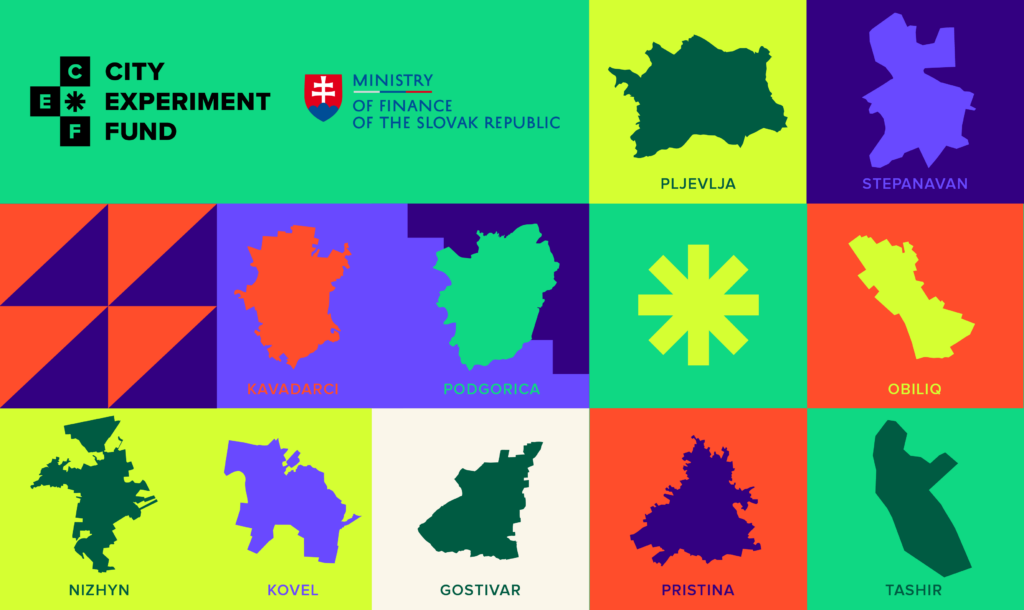

City Experiment Fund

City Experiment Fund (CEF) je iniciatíva v rámci projektu Slovenského transformačného fondu, ktorá podporuje systémovú transformáciu miest v Európe a strednej Ázii. Tento fond využíva portfóliový prístup založený na systémovom myslení, ktorý mestám pomáha riešiť komplexné výzvy prostredníctvom vzájomne prepojených riešení, ktoré podporujú inovácie, inkluzívnosť a odolnosť.

Hlavné výsledky CEFu doteraz:

Transformácia miest: CEF preukázal svoj vplyv konkrétne pri transformácii piatich miest – Skopje, Almaty, Stepanavan, Pljevlja a Priština. Tieto mestá riešili prostredníctvom inovatívnych portfólií problémy ako odpadové hospodárstvo, znečistenie ovzdušia, zamestnanosť mladých ľudí, energetická účinnosť a bezpečnosť v mestách. Aktivity boli špecificky prispôsobené pre jednotlivé mestá, čo sa vo výsledku aj osvedčilo. Príkladmi sú vznik prvého biohackingového laboratória v Skopje v Severnom Macedónsku či program energetickej efektívnosti obytných budov v Čiernej Hore, ktorý poskytoval finančnú podporu majiteľom domov opatrenia úspory energie, vrátane vykurovacích systémov na báze peliet, výmeny okien a tepelnej izolácie obvodových plášťov budov. Program zasiahol 150 rezidencií a len pre Pljevlju získal finančné prostriedky vo výške 2,8 milióna eur.

Urýchlenie zmien prostredníctvom inovácií – CEF zavádza tri kľúčové inovácie v oblasti rozvoja miest:

- Systémové myslenie: pomáha mestám riešiť vzájomne prepojené mestské výzvy pomocou holistických stratégií.

- Portfóliový prístup: prechod od izolovaných projektov k integrovaným portfóliám, ktoré riešia výzvy ako celok, čím sa dosahuje väčší vplyv zavedených zmien.

- Dynamické riadenie: využívanie spätnej väzby a vnímania v reálnom čase na zdokonaľovanie stratégií a reagovanie na vyvíjajúce sa potreby.

Posilnenie postavenia miest prostredníctvom strategických zmien: Od roku 2025 CEF rozširuje svoj vplyv prostredníctvom vytvorenia tematických skupín, ktoré spájajú mestá čeliace podobným výzvam s cieľom podnietiť kolektívne vzdelávanie a efektívnu implementáciu opatrení. Program sa zameria na inovatívne mechanizmy financovania a ponúkne mestám nástroje na urýchlenie ich transformácie. Do najnovšej skupiny bolo vybraných 10 miest, ktoré budú spoluvytvárať a realizovať strategické inovačné portfóliá so zameraním na využívanie digitálnych a ekologických inovácií.

Posilnenie postavenia miest prostredníctvom strategických zmien: Od roku 2025 CEF rozširuje svoj vplyv prostredníctvom vytvorenia tematických skupín, ktoré spájajú mestá čeliace podobným výzvam s cieľom podnietiť kolektívne vzdelávanie a efektívnu implementáciu opatrení. Program sa zameria na inovatívne mechanizmy financovania a ponúkne mestám nástroje na urýchlenie ich transformácie. Do najnovšej skupiny bolo vybraných 10 miest, ktoré budú spoluvytvárať a realizovať strategické inovačné portfóliá so zameraním na využívanie digitálnych a ekologických inovácií.

Úzkym prepojením s programom BOOST spája portfóliá miest s inovatívnymi riešeniami, čím podporuje regionálnu spoluprácu. Prvým krokom k vytváraniu portfólií bol tréningový program Bootcamp v Bratislave, ktorý sa konal v apríli 2025.

BOOST

BOOST Impact Accelerator je program určený na posilnenie inovácií a riešenie závažných rozvojových výziev. BOOST bol spustený v roku 2020 ako reakcia na COVID-19. Neskôr rozšíril záber aj na otázky ako nerovnosť, správa vecí verejných, odolnosť, rodová rovnosť a opatrenia v oblasti klímy. Vytvoril metodiku, ktorá presahuje svoj pôvodný rozsah a podporuje inovácie v celom regióne aj mimo neho.

V rokoch 2020 až 2024 BOOST úspešne spustil sedem akceleračných programov a spolupracoval s viac ako 200 mimovládnymi organizáciami, startupmi, malými a strednými podnikmi a akademickými inštitúciami. Tieto programy sa zaoberali rôznymi výzvami vrátane zlepšenia kvality ovzdušia, zlepšenia predpovedania povodní, rozšírenia prístupu k vzdelávaniu a podpory posilnenia postavenia žien v oblastiach STEM (veda, technológie, inžinierstvo a matematika). Medzi kľúčové úspechy, ktoré Slovensko podporilo, patrí Kirgizský vesmírny program inšpirujúci dievčatá v oblasti STEM, albánsky ConsciESG rozvíjajúci nástroje ESG (prepojenie spoločensky a sociálne zodpovedného investovania a investičných stratégií) a arménska technologická aplikácia Safe You bojujúca proti rodovo podmienenému násiliu, ktorá sa rozširuje do nových krajín.

BOOST podporuje rodovú rovnosť prostredníctvom iniciatív ako program Women Innovators, ktorý podporil 45 organizácií vedených ženami v 16 krajinách. Tieto programy poskytli granty, mentoring a platformu na rozširovanie efektívnych riešení. Príkladom je Slovenský ženský algoritmus, ktorý rozšíril svoju pôsobnosť na ukrajinských utečencov a získal ďalšie finančné prostriedky od Európskej banky pre obnovu a rozvoj.

BOOST podporuje rodovú rovnosť prostredníctvom iniciatív ako program Women Innovators, ktorý podporil 45 organizácií vedených ženami v 16 krajinách. Tieto programy poskytli granty, mentoring a platformu na rozširovanie efektívnych riešení. Príkladom je Slovenský ženský algoritmus, ktorý rozšíril svoju pôsobnosť na ukrajinských utečencov a získal ďalšie finančné prostriedky od Európskej banky pre obnovu a rozvoj.

BOOST sa stále viac prepája so City Experiment Fund, čím sa dosahujú väčšie synergie medzi mestskými portfóliami a riešeniami. Programy ako Pitch Back, ktorý spája absolventov s investormi a mentormi, sú príkladom snahy o dlhodobý vplyv. BOOST tiež plánuje posilniť sieť absolventov, podporiť tematické výzvy a zaviesť inovatívne modely financovania. Zostane tak základným kameňom systémových inovácií.

Zelené tokeny: Motivácia ekologicky uvedomelého správania

City Experiment Fund (CEF) spolupracoval s Resource Mobilization Facility, ktorý sa realizuje v rámci projektu Verejné a súkromné financie pre rozvoj, na navrhnutí systému tokenov v partnerských mestách CEF. Táto iniciatíva je zameraná na motiváciu ekologicky uvedomelého správania prostredníctvom systému tokenizácie založeného na technológii blockchain. Projekt sa realizoval v hlavnom meste Severného Macedónska v Skopje, kde sa zameral na udržateľné nakladanie s biologickým odpadom. V čiernohorskej Podgorici sa zameral na podporu udržateľnej verejnej dopravy. Vypracovali sme štúdie uskutočniteľnosti a plány pre tokenový systém, ktorý motivuje jednotlivcov a podniky k prijímaniu ekologických postupov, ako je správne triedenie odpadu a väčšie využívanie verejnej dopravy. Na projekte spolupracovali miestni partneri vrátane spoločností zaoberajúcich sa odpadovým hospodárstvom, supermarketov a zástupcov sektora HORECA (hotel, reštaurácia, kaviareň). Projekt pripravil jedinečné riešenia šité na mieru pre každé mesto a zároveň navrhol modely, ktoré sa dajú prispôsobiť pre iné mestá.

Ďalším krokom je zabezpečenie financovania prostredníctvom mestských rozpočtov, partnerstiev so súkromným sektorom alebo platformami ako Cardano Project Catalyst a rozšírenie iniciatívy Zelené tokeny na celom západnom Balkáne.

Národná rozvojová stratégia Severného Macedónska na roky 2022-2042

MFSR prostredníctvom národnej kancelárie UNDP pomáhalo vláde Severného Macedónska s prípravou Národnej rozvojovej stratégie na roky 2022 – 2042. Táto stratégia je najkomplexnejším rámcom zameraným na koordinovaný rozvoj krajiny.

MFSR pomohlo vytvoriť systém štruktúrovanej spolupráce na národnej úrovni. Na znení, komunikácii, monitorovaní a úprave stratégie sa podieľajú kľúčové zainteresované strany vrátane verejnosti.

Ministerstvo dát

MF SR podporilo aj vlajkovú iniciatívu UNDP, Ministerstvo dát. Prostredníctvom tohto programu boli vyhlásené tri kolá otvorených výziev na vývoj nástrojov založených na dátach a spoločných riešeniach, ktoré riešia sociálno-ekonomické výzvy ako je znečistenie ovzdušia a mestská mobilita. Do iniciatívy sa zapojilo viac ako 1 000 mladých ľudí v 13 krajinách, pričom viac ako 600 účastníkov predložilo 150 nápadov. Okrem toho vznikli cenné zdroje vrátane Príručky ministerstva dát, ktorá ponúka návod na využívanie nových zdrojov dát, a Príručky ministerstva dát na úspešné riešenie výziev v oblasti inovácií dát. Táto iniciatíva bola podporená prostredníctvom vyššie uvedeného programu Transformatívne vládnutie a financovanie.

MF SR podporilo aj vlajkovú iniciatívu UNDP, Ministerstvo dát. Prostredníctvom tohto programu boli vyhlásené tri kolá otvorených výziev na vývoj nástrojov založených na dátach a spoločných riešeniach, ktoré riešia sociálno-ekonomické výzvy ako je znečistenie ovzdušia a mestská mobilita. Do iniciatívy sa zapojilo viac ako 1 000 mladých ľudí v 13 krajinách, pričom viac ako 600 účastníkov predložilo 150 nápadov. Okrem toho vznikli cenné zdroje vrátane Príručky ministerstva dát, ktorá ponúka návod na využívanie nových zdrojov dát, a Príručky ministerstva dát na úspešné riešenie výziev v oblasti inovácií dát. Táto iniciatíva bola podporená prostredníctvom vyššie uvedeného programu Transformatívne vládnutie a financovanie.

Alternatívne finančné laboratórium

Alternatívne finančné laboratórium je mechanizmus na skúmanie a využívanie nových finančných technológií na zvýšenie investícií na dosiahnutie cieľov trvalo udržateľného rozvoja.

Slovensko pôvodne podporovalo UNDP (v rámci projektu Transformačný nástroj pre verejnú správu a financie) pri skúmaní využívania inovatívnych mechanizmov financovania, ako sú crowdfunding, dopadové investovanie, blockchain technológie alebo islamské modely financovania. Táto iniciatíva, pôvodne financovaná a založená zo slovenských zdrojov, sa rozrástla na vplyvnú nezávislú odbornú platformu, ktorá sa naďalej rozširuje a diverzifikuje, pričom jej rozpočet mnohonásobne presiahol pôvodné financovanie zo Slovenska.

Potenciál investovania so sociálnym dopadom (tzv. social impact bonds) v posledných rokoch získava čoraz väčšiu pozornosť. Jedným z výsledkov spolupráce UNDP a Slovenska je zavedenie prvého dlhopisu so sociálnym dopadom v Arménsku, ktorého cieľom je pomoc farmárom v mliekarňach. Projekt týmto výrazne prispel aj k boju proti chudobe u špecifickej skupiny obyvateľov, keďže podporil vyššiu produktivitu a teda zabezpečil vyšší príjem domácností.

V krajinách západného Balkánu alebo Východného partnerstva skúmal tím UNDP komunálne a štátne dlhopisy prostredníctvom iniciatívy miestnych samospráv Breathe Better Bond, ktorá je spojená s technickou pomocou. Výnosy z nej sa používajú na projekty, ktoré znižujú znečistenie ovzdušia.

V spolupráci s kanceláriou UNDP v Maroku bol podporený návrh digitálneho pasu, ktorý uľahčuje priamy obchod s argánovým olejom medzi ženskými družstvami v juhozápadnom Maroku a vývozcami a odberateľmi. Toto riešenie podporuje elektronický predaj a zároveň buduje odolné podniky. V Srbsku pomáhal projektový tím pri pilotnom využívaní blockchainu na prevody peňazí z diaspóry s cieľom znížiť náklady na prevody peňazí a zvýšiť transparentnosť. V Ekvádore sa podporilo uvedenie prvej čokoládovej tyčinky na svete so zdieľanou hodnotou založenej na blockchaine. Využitá technológia pomáha poľnohospodárom chrániť životné prostredie. Z týchto aktivít, ktoré pôvodne vznikli vďaka podpore Slovenska, sa medzičasom stali samostatne fungujúce iniciatívy.

MF SR spolu s EXIMBANKOU SR investujú do podpory zapájania slovenských podnikateľov do projektov v rozvojových krajinách cez dve spoločné iniciatívy: výkon úlohy kontaktného miesta pre súkromný sektor (PSLO) a program zvýhodnených vývozných úverov.

Exportno-importná banka Slovenskej republiky, skrátene EXIMBANKA SR, je slovenská exportno-úverová agentúra založená pod záštitou Ministerstva financií Slovenskej republiky. Od svojho vzniku v roku 1997 sa zameriava predovšetkým na zahraničnoobchodné operácie a podporu slovenských vývozcov s cieľom zvýšiť konkurencieschopnosť domáceho tovaru a služieb a vzájomnú hospodársku výmenu Slovenskej republiky s ostatnými krajinami. Vzhľadom na stále väčší dopyt po aktívnej účasti súkromného sektora na rozvojovej spolupráci sa EXIMBANKA SR postupne stala dôležitou súčasťou rozvojového ekosystému SR.

Rozšírením svojho mandátu o činnosti rozvojovej spolupráce a následným rozšírením svojho portfólia vytvára príležitosti pre slovenské spoločnosti v rozvojových krajinách, čím prispieva k ich udržateľnému hospodárskemu a sociálnemu napredovaniu.

Od roku 2020 vykonáva EXIMBANKA SR úlohu kontaktného miesta pre slovenský súkromný sektor (PSLO). PSLO je sieť organizácií v takmer stovke krajín, ktorých cieľom je podporiť a facilitovať komunikáciu Skupiny Svetovej banky so súkromným sektorom. EXIMBANKA SR sa zameriava na uľahčenie kontaktu slovenských firiem nielen so Skupinou Svetovej banky, ale aj inými medzinárodnými finančnými inštitúciami (napr. Európska investičná banka, Európska banka pre obnovu a rozvoj, Rozvojová banka Rady Európy a iné). Sprostredkuje a zjednodušuje prístup k obchodným príležitostiam a poskytuje poradenstvo v oblasti zapájania sa do rozvojových aktivít.

Exportérom slovenských tovarov a služieb EXIMBANKA SR tiež poskytuje program zvýhodnených vývozných úverov. Tento nástroj rozvojovej spolupráce dáva vývozcovi možnosť ponúknuť zahraničnému odberateľovi z verejného sektora v rámci vybraných krajín zvýhodnené financovanie. Zvýhodnenie sa môže realizovať formou príspevku na zníženie istiny alebo úrokov, predĺženej doby splatnosti úveru, a pod. a dosahuje výšku 35% alebo až 50% z celkového objemu zákazky, v závislosti od krajiny. Úverová schéma je navrhnutá v súlade s pravidlami Svetovej obchodnej organizácie a Organizácie pre hospodársku spoluprácu a rozvoj, najmä s Dohovorom pre oficiálne podporované vývozné úvery (Konsenzus OECD).

Cieľom tohto nástroja je podpora komerčne nerealizovateľných projektov, uľahčenie prístupu k financiám pre partnerské krajiny a otvorenie dverí slovenským spoločnostiam v rozvojových krajinách. Umožňuje tým exportérovi zapojiť sa do projektov, ktoré prispievajú k rozvoju ekonomiky a spoločnosti v cieľovej krajine a zároveň priaznivo vplývajú aj na slovenské firmy a ekonomiku. Rozvojový aspekt projektu je zároveň aj podmienkou získania finančného príspevku z fondov určených na slovenskú rozvojovú spoluprácu. Dohliada naň Ministerstvo financií SR spolu s Ministerstvom zahraničných vecí a európskych záležitostí SR.

Ďalšie príležitosti pre rozšírené zapájanie EXIMBANKY SR a slovenských podnikateľov do rozvojových aktivít prinesie aj spolupráca s EÚ. V roku 2021 EXIMBANKA SR úspešne absolvovala proces tzv. Pillar Assessment-u (certifikácia zo strany Európskej komisie), čím sa stala oprávnenou inštitúciou na realizáciu delegovanej spolupráce EÚ. V praxi to znamená, že EXIMBANKA SR sa môže uchádzať o implementáciu rozvojových projektov EÚ (napr. v rámci iniciatívy Global Gateway alebo investičného nástroja pre Ukrajinu) a prinášať zaujímavé príležitosti aj pre slovenské firmy.

Ministerstvo financií SR sa stalo členom programu PEFA (Public Expenditure and Financial Accountability – Verejné výdavky a finančná zodpovednosť) v apríli 2019. PEFA spája 7 partnerov z rôznych krajín, ktorí patria k najaktívnejším donorom v oblasti riadenia verejných financií. Medzi hlavné ciele programu spadá propagácia správneho riadenia verejných financií, ktoré sa prejavuje v hospodárnom využívaní verejných zdrojov a kvalitnejších služieb občanom. Kľúčovým komponentom programu je „PEFA hodnotenie“, ktoré je vnímané odbornou verejnosťou ako univerzálny, komplexný a veľmi relevantný nástroj na meranie pokroku prebiehajúcich reforiem v riadení verejných financií. Okrem vylepšovania tejto PEFA metodiky sú súčasťou programu aj propagácia výskumu v riadení verejných financií a posilňovanie kapacít, pričom sa zameriava aj na klímu a rodovú rovnosť ako dôležité aspekty cyklu riadenia verejných financií.

Program PEFA vznikol v roku 2001 a funguje vo forme zvereneckého fondu (multi-donor trust fund). Slovensko sa stalo členom tejto prestížnej odbornej iniciatívy v roku 2019 ako prvý z tzv. nových donorov. Pozvánku na prijatie členstva Slovensko dostalo vďaka zapájania sa do rozvojových projektov v riadení verejných financií a skúseností v posilňovaní partnerských krajín v tejto oblasti. Ministerstvo financií SR sa snaží stať aktívnym členom a prispievať k hodnoteniam alebo ich revízii vlastnou expertízou v rôznych témach ohľadom riadenia verejných financií.

Program PEFA vznikol v roku 2001 a funguje vo forme zvereneckého fondu (multi-donor trust fund). Slovensko sa stalo členom tejto prestížnej odbornej iniciatívy v roku 2019 ako prvý z tzv. nových donorov. Pozvánku na prijatie členstva Slovensko dostalo vďaka zapájania sa do rozvojových projektov v riadení verejných financií a skúseností v posilňovaní partnerských krajín v tejto oblasti. Ministerstvo financií SR sa snaží stať aktívnym členom a prispievať k hodnoteniam alebo ich revízii vlastnou expertízou v rôznych témach ohľadom riadenia verejných financií.

Viac informácií o programe PEFA: https://www.pefa.org/

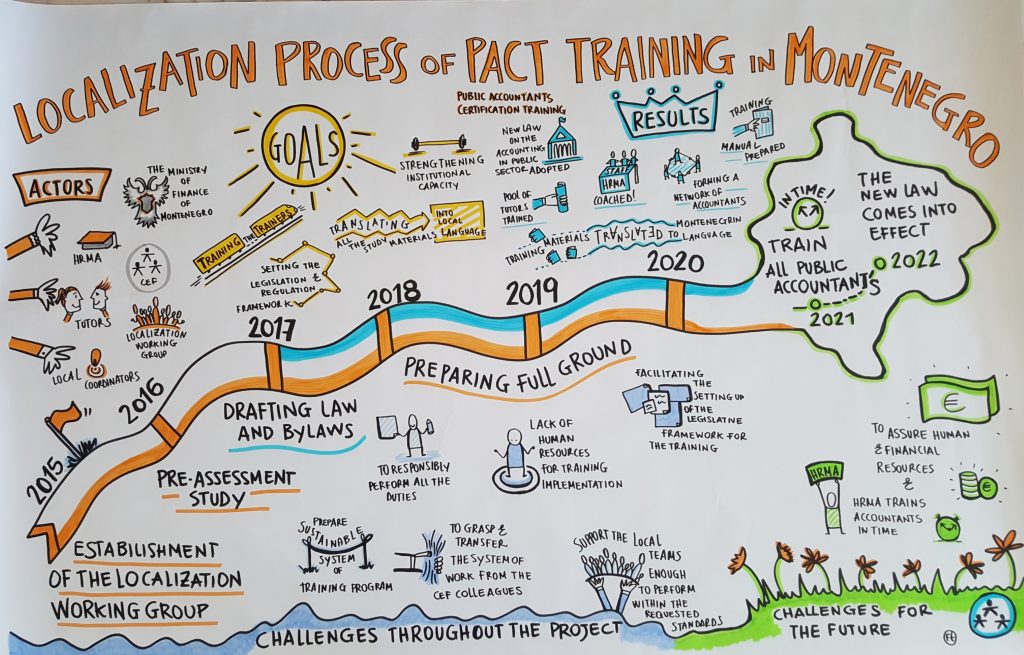

MF SR, ktorého cieľom je odovzdávanie a výmena poznatkov a poskytovanie technickej pomoci pri správe verejných financií, začalo v roku 2010 spolupracovať s organizáciou Center of Excellence in Finance (CEF). CEF je medzinárodná organizácia so sídlom v slovinskej Ľubľane. Jej poslaním je podporovať vzdelávanie a rozvoj finančných úradníkov v juhovýchodnej Európe. Od roku 2018 je ministerstvo členom Poradného výboru a Správnej rady CEF.

SÚČASNÁ SPOLUPRÁCA MF SR A CEF

SÚČASNÁ SPOLUPRÁCA MF SR A CEF

MF SR za posledné desaťročie aktívne prispelo k viacerých iniciatívam v oblasti zlepšovania riadenia verejných financií na západnom Balkáne a v krajinách Východného partnerstva. Spolupráca je založená na implementácii dlhodobých bilaterálnych projektov a na spoločných vzdelávacích aktivitách pre partnerské krajiny. Tieto snahy dopĺňajú programy, ktoré má ministerstvo, ako aj CEF, s ďalšími rozvojovými partnermi, napríklad s Rozvojovým programom OSN (UNDP) a s EÚ. Za dosiahnutými výsledkami stoja slovenské skúsenosti a odborné znalosti v oblasti riadenia verejných financií a rozvojovej spolupráce.

Medzi hlavné iniciatívy ministerstva a CEF patrí projekt Rozvoj efektívnych a odolných daňových inštitúcií (TAX), ktorého cieľom je zvýšiť verejné príjmy v rozvojových krajinách juhovýchodnej Európy zlepšením ich daňových systémov. Ďalším kľúčovým projektom je Účtovníci a audítori pre zodpovedný verejný sektor (EAPS), ktorý sa zameriava na posilnenie zodpovednosti inštitúcií verejného sektora v tom istom regióne prostredníctvom rozvoja odborných kapacít audítorov a účtovníkov.

Tieto nové projekty nadväzujú na úspešnú predchádzajúcu spoluprácu vrátane projektu Certifikované vzdelávanie účtovníkov verejného sektora PACT2 v Severnom Macedónsku, ako aj projektu Certifikované vzdelávanie účtovníkov verejného sektora PACT1 a PACT3 v Čiernej Hore.

Vďaka spolupráci ministerstva s CEF majú slovenskí experti možnosť odovzdávať svoje poznatky a skúsenosti. Zároveň je to príležitosť učiť sa od svojich kolegov v zahraničí.

ĎALŠIE AKTIVITY MF SR

Zdieľanie skúseností z reforiem v oblasti riadenia verejných financií vrátane tých, ktoré sa týkajú mobilizácie domácich príjmov verejných rozpočtov sú jedným zo základných kameňov slovenskej rozvojovej spolupráce. Ministerstvo financií SR sa preto v roku 2015 pripojilo k iniciatíve Addis Tax Initiative. Tým sa stalo súčasťou širokej medzinárodnej siete kľúčových hráčov, ktorí aktívne pôsobia v oblasti daní a rozvoja.

Addis Tax Initiative (ATI) je medzinárodné partnerstvo, ktoré sa zameriava na presadzovanie daňovej spravodlivosti, budovanie efektívnych daňových systémov a boj proti daňovým únikom. Jedným z jeho cieľov je zlepšiť mobilizáciu domácich príjmov verejných rozpočtov (tzv. Domestic Resource Mobilization – DRM) v partnerských krajinách, keďže práve tá je podľa ATI najudržateľnejším a najspoľahlivejším zdrojom financovania rozvoja.

learn4dev je medzinárodná sieť rozvojových organizácií, ktorá vznikla s cieľom poskytnúť svojim členom lepšie možnosti vzájomného vzdelávania. Ide o platformu, ktorá ponúka školenia a odovzdávanie skúseností a vedomostí v kľúčových oblastiach medzinárodnej rozvojovej spolupráce. V súčasnosti sieť združuje 36 členských organizácií vrátane bilaterálnych donorských organizácií, multilaterálnych donorských organizácií a medzinárodných vzdelávacích a výskumných centier.

Ministerstvo financií Slovenskej republiky je aktívnym členom learn4dev od roku 2017. Pre viac informácií o sieti learn4dev navštívte ich stránku.

MF SR sa zmluvne zaviazalo prispieť v rokoch 2022 – 2025 sumou 7 mil. eur do Fondu pre znižovanie chudoby a rast (PRGT) Medzinárodného menového fondu (MMF), ktorého cieľom je znižovanie následkov pandémie COVID-19. Fond poskytuje najmenej rozvinutým krajinám zvýhodnené, aktuálne bezúročné financovanie.

MF SR sa tiež snaží podporiť Ukrajinu pri reforme systémov verejných financií. Vzhľadom na situáciu v teréne a obmedzené kapacity na priamu bilaterálnu výmenu poznatkov sa MF SR rozhodlo zapojiť do aktivít medzinárodných partnerov a podporilo dva programy v oblasti riadenia verejných financií:

- Prvým je Ukrajinský fond rozvoja kapacít patriaci pod MMF, zameraný na komplexné budovanie kapacít, cielené opatrenia v oblasti makroekonomickej a finančnej stability a kritické štrukturálne reformy.

- Druhým programom je Ukrajinský národný program, ktorý realizuje Organizácia pre hospodársku spoluprácu a rozvoj (OECD) a v rámci ktorého MF SR podporuje revíziu daňovej politiky Ukrajiny.